Union Budget 2023-24 Highlights & Complete Budget Analysis

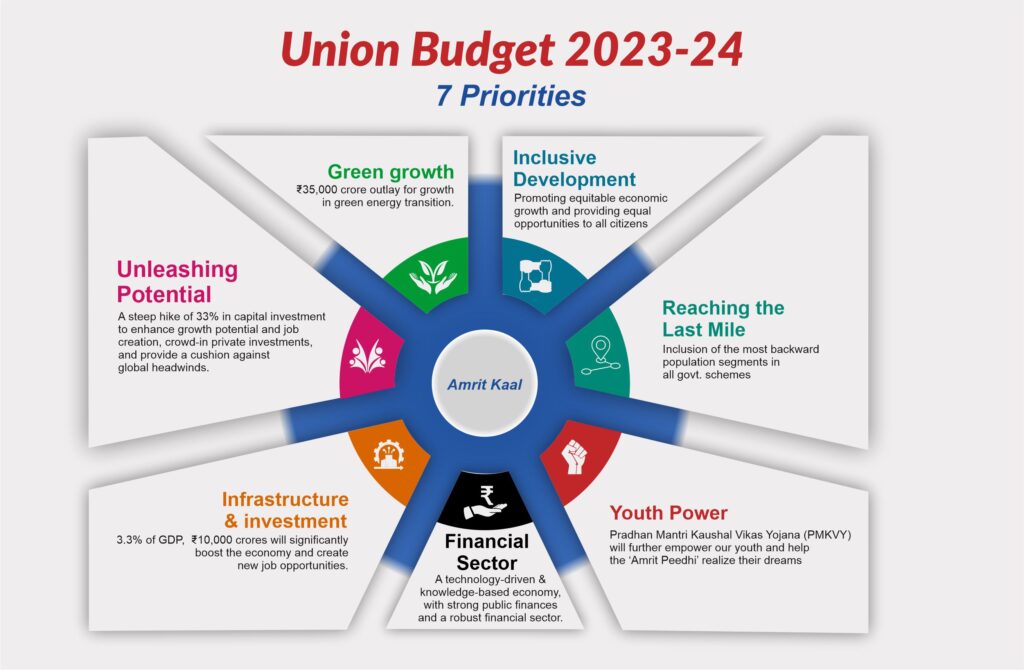

The finance minister said that our economy is on the right track and heading toward a bright future. Adopting seven priorities to guide India through the “Amrit Kaal”, including inclusive development, reaching the last mile, infrastructure and investment, unleashing the potential, green growth, youth power, and financial sector.

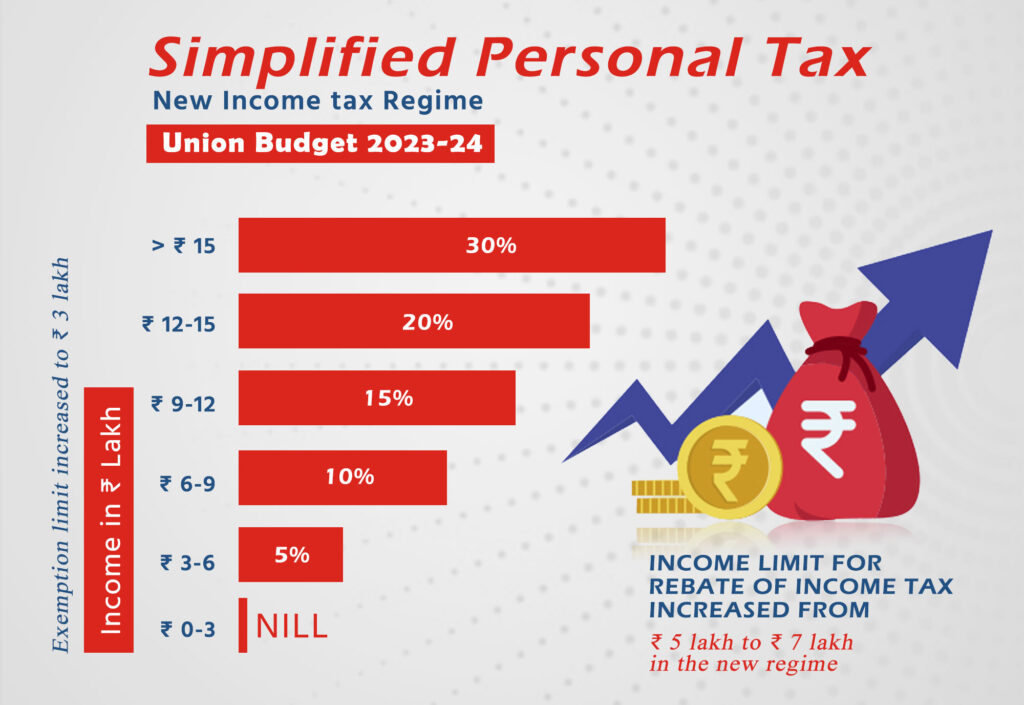

Income Tax Changes in union budget 2023

Govt. has tried to boost consumption through the middle class with a change in the tax slabs.

- There are a few incentives to be offered to shift to the new tax regime. The old regime however remains acceptable.

- There’ll be no Income Tax for salaries up to 7 LPA in the new tax regime as the rebate limit has increased from Rs 5 LPA to 7 LPA.

- Individuals earning more than Rs 5 crore PA, pay a surcharge of 25% under the new regime as opposed to 37% under the old regime.

- The tax collected at source (TCS) of 20% will be applied on foreign remittances to tax foreign holidays and expenses and realty investments abroad. This will exclude payments for education and health.

The idea behind slashing taxes is to increase the disposable income in the hands of the consumer, raise demand and boost consumption. The focus of the old regime was tax-saving instruments. The new generation is looking at different investment options, not necessarily tax saving.

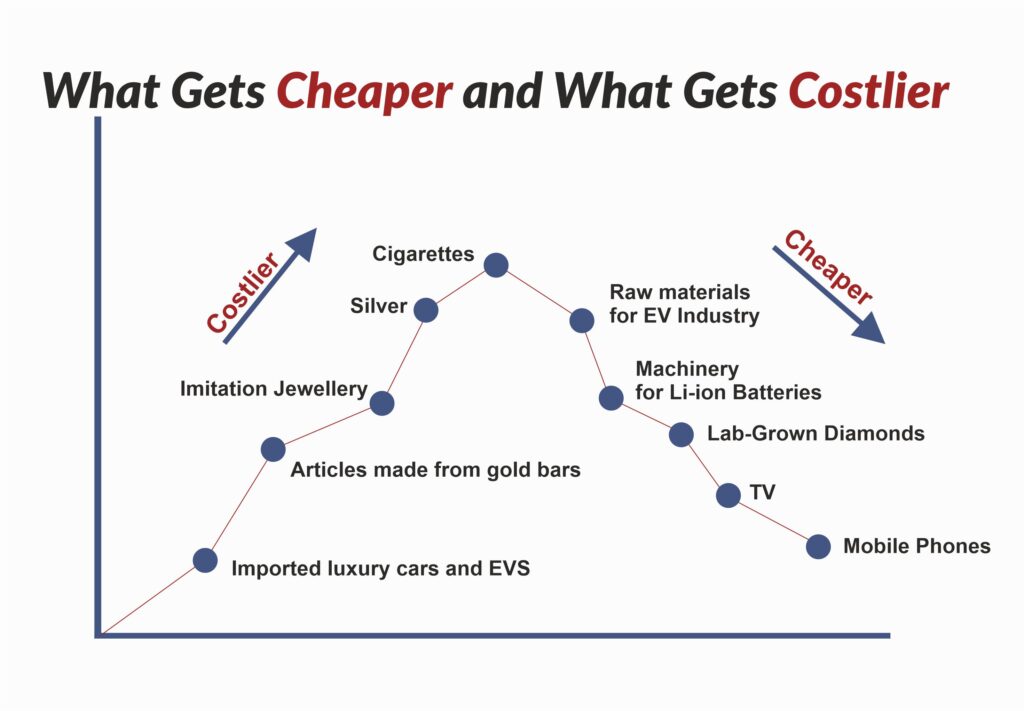

What gets cheaper and what gets costlier

Hattrick of boosting Capital Expenditure, Slashing Taxes, and reducing Fiscal Deficit will benefit India’s economy a lot. The Capital Expenditure (CapEx) is going to raise by 33% to ₹10 lakh crore for the next fiscal year starting from 1st April, which is 3.3% of the country’s economic output. But, on an individual level, we all wait for the list of items that get costlier and cheaper.

- Customs duty cut on components for TVs, Mobile phones to boost domestic production. Also on machinery and components for the manufacture of Lithium-ion batteries in the use of Electric Vehicles

- Customs duty increase on Kitchen chimneys, Electric Vehicles, imitation jewelry, and precious metals. Cigarettes to become dearer.

Other Schemes and Benefits in union budget 2023

- Marginalized sections Including Farmers, Women, and Sr. Citizens will be benefitted with the senior Citizen Deposit Limit increased to 30 lakhs from 15 lakhs and with a lock-in period of 5 years.

- The Monthly Income Scheme limit was enhanced to Rs 9 lakhs from Rs. 4.5 Lakhs for individual accounts and 15 lakhs from 9 lakhs for joint accounts.

- Mahila Samman Savings Certificate will be launched in March 2025. Max. deposit of Rs. 2 Lakh at a fixed interest rate of 7.5%, eligible for partial withdrawal.

- The Agri credit is increased by 20 lakh crore and an Agriculture Accelerator Fund will be set up to encourage agri-startups by young entrepreneurs. They will improve mobility, facilitate trade, lead to job creation, and boost overall economic productivity. Capital investment outlay increased by 33 percent to ₹10 lakh crore, which is 3.3% of GDP.

- The Green Energy Transition will get an outlay of ₹35,000 crores and a Green Credit Programme will be notified under the Environment Protection Act,1986.

“This will incentivize environmentally sustainable and responsive actions by companies, individuals, and local bodies, and help mobilize additional resources for such activities,”

-Nirmala Sitharaman