CBDC: The future of Indian Banking

Central Bank Digital Currency (CBDC) is the digital version of a country’s conventional government-issued money, issued and supported by the Central Bank. It aims to provide a digital alternative to cash and enhance the efficiency of the financial system by leveraging technology.

It has the potential to revolutionize the banking industry by providing a digital alternative to cash, increasing accessibility, and financial inclusion, and enhancing the efficiency of the financial system. It can help bridge the gap between the formal and informal economy and bring a significant portion of the population into the formal banking system.

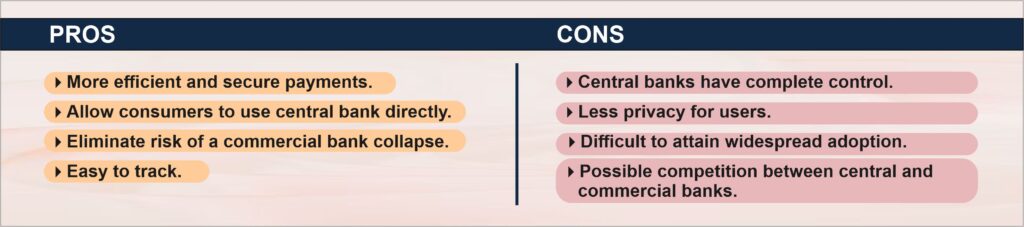

The introduction of CBDC raises a number of regulatory and legal issues including the legal status of CBDC, the regulation of transactions, and the protection of consumers. There are concerns about how CBDC will interact with existing laws and regulations, such as anti-money laundering laws and Know-Your-Customer requirements.

Developing and implementing CBDC requires a significant investment in technology and infrastructure. This includes the development of digital wallets, the creation of a secure digital infrastructure, and the integration of CBDC with existing systems. Concerns about scalability and security in relation to the number of transactions that can be processed at any one time also exist.

It is expected to disrupt traditional banks and financial institutions as it will reduce the need for physical banking infrastructure and lower costs for consumers, leading to a reduction in revenue for traditional banks raising the concerns that CBDC would evolve new paradigms of competition and reduce entry barriers of new entrants into the banking sector.

It has the potential to revolutionize the banking industry by providing a digital alternative to cash, increasing accessibility, and financial inclusion, and enhancing the efficiency of the financial system. It can help bridge the gap between the formal and informal economy and bring a significant portion of the population into the formal banking system.

The introduction of CBDC raises a number of regulatory and legal issues including the legal status of CBDC, the regulation of transactions, and the protection of consumers. There are concerns about how CBDC will interact with existing laws and regulations, such as anti-money laundering laws and Know-Your-Customer requirements.

Developing and implementing CBDC requires a significant investment in technology and infrastructure. This includes the development of digital wallets, the creation of a secure digital infrastructure, and the integration of CBDC with existing systems. Concerns about scalability and security in relation to the number of transactions that can be processed at any one time also exist.

It is expected to disrupt traditional banks and financial institutions as it will reduce the need for physical banking infrastructure and lower costs for consumers, leading to a reduction in revenue for traditional banks raising the concerns that CBDC would evolve new paradigms of competition and reduce entry barriers of new entrants into the banking sector.

Several countries are already exploring or have implemented CBDC before India, including China, Sweden and the Bahamas. China is one of the leading countries in the development of CBDC, with the People’s Bank of China (PBOC) having launched a pilot program for its digital currency, the Digital Yuan. Similarly, Sweden’s central bank, Riksbank, has been exploring the potential of an e-krona, Bahamas has launched a pilot program for its digital currency, the Sand Dollar, and India is also in the race with others for its digital currency, the Digirupee.

The Indian banking system has undergone significant changes in recent years, with the government promoting digitalization and financial inclusion through various initiatives. But, despite these efforts, a large percentage of the population still remains unbanked or underbanked.

The banking system in India will benefit a lot because of this by providing increased accessibility and financial inclusion, enhanced security and reduced fraud, improved efficiency and faster transactions, and the potential for lower costs for consumers and businesses.

In India, CBDC has the potential to be used in a variety of ways like an increase in accessibility and financial inclusion that too particularly in rural areas, and also to support digital payments and e-commerce. CBDC could be used to improve the efficiency of government welfare programs by reducing the need for intermediaries and increasing the speed of transactions.

The Indian banking system has undergone significant changes in recent years, with the government promoting digitalization and financial inclusion through various initiatives. But, despite these efforts, a large percentage of the population still remains unbanked or underbanked.

The banking system in India will benefit a lot because of this by providing increased accessibility and financial inclusion, enhanced security and reduced fraud, improved efficiency and faster transactions, and the potential for lower costs for consumers and businesses.

In India, CBDC has the potential to be used in a variety of ways like an increase in accessibility and financial inclusion that too particularly in rural areas, and also to support digital payments and e-commerce. CBDC could be used to improve the efficiency of government welfare programs by reducing the need for intermediaries and increasing the speed of transactions.

The government of India has announced that it is considering the use of blockchain technology to implement CBDC. Blockchain is a decentralized, disseminated, and public digital ledger used to record transactions across the network of computers, so the record can’t be changed retroactively without modifying every single ensuing block and the consensus of the network. The CBDC operates on private authorised blockchains.

The Reserve Bank of India (RBI) issued a concept note on Central Bank Digital Currency (CBDC) on October 7, 2022, and launched two pilot programs where the first was a wholesale CBDC effort (CBDC-W), which began on November 1, 2022, averaging ₹325 crore worth of deals per day in November, and the second retail CBDC (CBDC-R) pilot program created ₹3 crore digital currencies in the first two days of the pilot which was launched on December 1, 2022, to test the feasibility of the digital rupee.

The retail CBDC pilot conducted two phases where the first phase involved testing the technical and operational aspects of a digital rupee with a focus on handling transaction volumes that are small because most transactions were very low value covering Mumbai, New Delhi, Bengaluru, and Bhubaneswar, while the second phase involved extension with the aim of assessing the technology’s readiness to handle large volumes of transactions growing to Ahmedabad, Gangtok, Guwahati, Hyderabad, Indore, Kochi, Lucknow, Patna, and Shimla.

So far, the pilot has done 7,70,000 transactions in 2 months with more than 50,000 customers and 10,000 small and big merchants have been onboarded now. Earlier, eight banks participated including State Bank of India, ICICI Bank, Yes Bank, IDFC First Bank, Bank of Baroda, Union Bank of India, HDFC Bank, and Kotak Mahindra Bank, and now five more banks are onboarding and another nine cities are planned.

The case studies and examples from other countries and the pilot programs and trials in India demonstrate the increasing interest in CBDC globally and the potential for their use in India. It will be important to consider the lessons learned from these pilots and case studies as India continues to explore the potential of CBDC.

The Reserve Bank of India (RBI) issued a concept note on Central Bank Digital Currency (CBDC) on October 7, 2022, and launched two pilot programs where the first was a wholesale CBDC effort (CBDC-W), which began on November 1, 2022, averaging ₹325 crore worth of deals per day in November, and the second retail CBDC (CBDC-R) pilot program created ₹3 crore digital currencies in the first two days of the pilot which was launched on December 1, 2022, to test the feasibility of the digital rupee.

The retail CBDC pilot conducted two phases where the first phase involved testing the technical and operational aspects of a digital rupee with a focus on handling transaction volumes that are small because most transactions were very low value covering Mumbai, New Delhi, Bengaluru, and Bhubaneswar, while the second phase involved extension with the aim of assessing the technology’s readiness to handle large volumes of transactions growing to Ahmedabad, Gangtok, Guwahati, Hyderabad, Indore, Kochi, Lucknow, Patna, and Shimla.

So far, the pilot has done 7,70,000 transactions in 2 months with more than 50,000 customers and 10,000 small and big merchants have been onboarded now. Earlier, eight banks participated including State Bank of India, ICICI Bank, Yes Bank, IDFC First Bank, Bank of Baroda, Union Bank of India, HDFC Bank, and Kotak Mahindra Bank, and now five more banks are onboarding and another nine cities are planned.

The case studies and examples from other countries and the pilot programs and trials in India demonstrate the increasing interest in CBDC globally and the potential for their use in India. It will be important to consider the lessons learned from these pilots and case studies as India continues to explore the potential of CBDC.