Understanding Cryptocurrency: Valuation, Blockchain and Workings

What Is Cryptocurrency?

Cryptocurrency is a kind of digital asset utilizing cryptography’s advanced encryption techniques to protect transactions and control the creation of new units. It functions independently from central banks and serves various purposes, including online shopping, investing, and even as a store of value.

These digital currencies operate on a decentralized network supported by a user community. This network is commonly known as a blockchain, a digital ledger of all transactions related to a particular cryptocurrency.

How Does It Work?

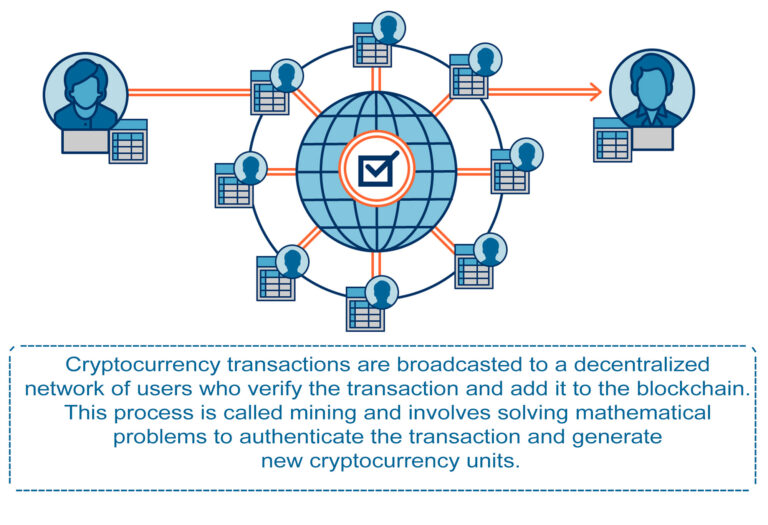

When a user initiates a transaction, the network of users broadcasts it to verify the transaction and include it in the blockchain. This process, called mining, involves solving intricate mathematical problems to authenticate the transaction and generate new cryptocurrency units.

Once a transaction is verified, it is added to a block, which is subsequently added to the blockchain. Each block in the chain carries a unique code or hash, produced through a cryptographic function. This ensures that each block is connected to the previous one in the chain, rendering the blockchain tamper-proof and secure. This process demands substantial energy and computing power, resulting in high production costs.

Understanding Blockchain:

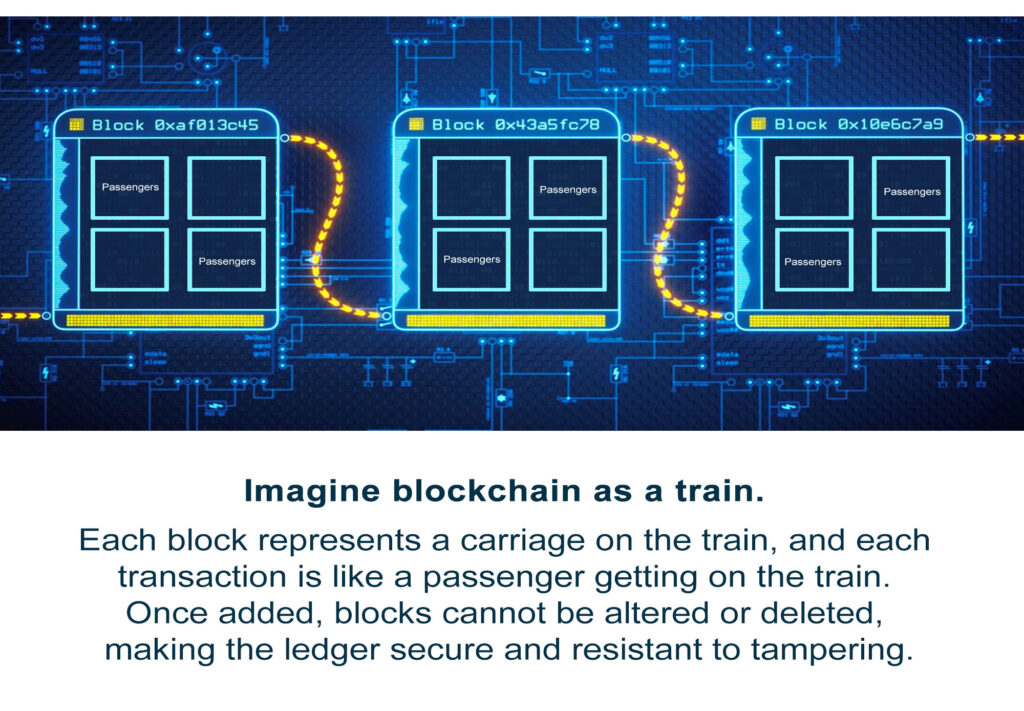

Blockchain is a decentralized record-keeping ledger that securely and transparently logs transactions. It uses cryptography to protect and validate transactions before adding them to the blockchain as blocks. Once added, blocks cannot be altered or deleted, making the ledger secure and resistant to tampering.

Imagine blockchain as a towering stack of Lego bricks. Each block lists transactions, representing a Lego piece, and every block is connected to the one beneath it, just like a Lego stacked over another. Once added, blocks cannot be removed or modified, similar to how a Lego piece in the middle of the stack cannot be removed or changed once connected.

Various types of blockchain technologies exist, including public, private, and hybrid blockchains. Public blockchains, such as Bitcoin, are open to everyone, while private blockchains are restricted to specific users or organizations. Hybrid blockchains incorporate features from both public and private blockchains.

How Is Cryptocurrency Valued?

The market’s supply and demand dynamics determine a cryptocurrency’s value, much like any other asset. When more people buy than sell, the price increases, and when more people sell than buy, the price decreases.

Several factors influence their values. Adoption rates are crucial in determining a cryptocurrency’s value. As more people use a cryptocurrency, its demand increases, driving up the price. Market sentiment also affects cryptocurrency value, with positive sentiment leading to higher prices and negative sentiment leading to lower prices. Regulatory changes, technological advancements, and competition from other cryptocurrencies and traditional currencies can impact cryptocurrency value. It’s essential to research and understand these and other factors thoroughly before investing in cryptocurrencies.

Journey of Cryptocurrency in India

Cryptocurrency has evolved significantly in India since its inception. The Reserve Bank of India issued a warning against using cryptocurrencies in 2013, but the government didn’t officially declare cryptocurrencies as non-legal tender until 2018. Despite this, the cryptocurrency industry continued to grow in India, with many individuals and companies investing in it.

In 2021, the government proposed a new Crypto Bill that would effectively ban all private cryptocurrencies and establish a central bank digital currency (CBDC) called DigiRupee. However, the bill hasn’t been passed into law yet, and various stakeholders oppose it.

In 2022, the government proposed a new Finance Bill that includes a flat 30% tax

on the transfer of virtual assets, including NFTs and cryptocurrencies. To accommodate this, a new Section 115BBH was added to the Income-tax Act, 1961.

As a result, there is now a 30% tax, plus a surcharge and cess on the transfer of any virtual digital asset (VDA) such as Bitcoin or Ethereum under the Income Tax Act, of 1961. However, the legal status of cryptocurrencies remains uncertain.

Currently, cryptocurrencies in India are unregulated. The government has, however, started cracking down on illegal activities involving cryptocurrencies, such as money laundering and tax evasion.

Despite the ambiguity surrounding cryptocurrencies in India, many believe they have the potential to revolutionize the financial industry in the country. Cryptocurrency adoption could lead to increased financial inclusion and access to financial services for millions of people.

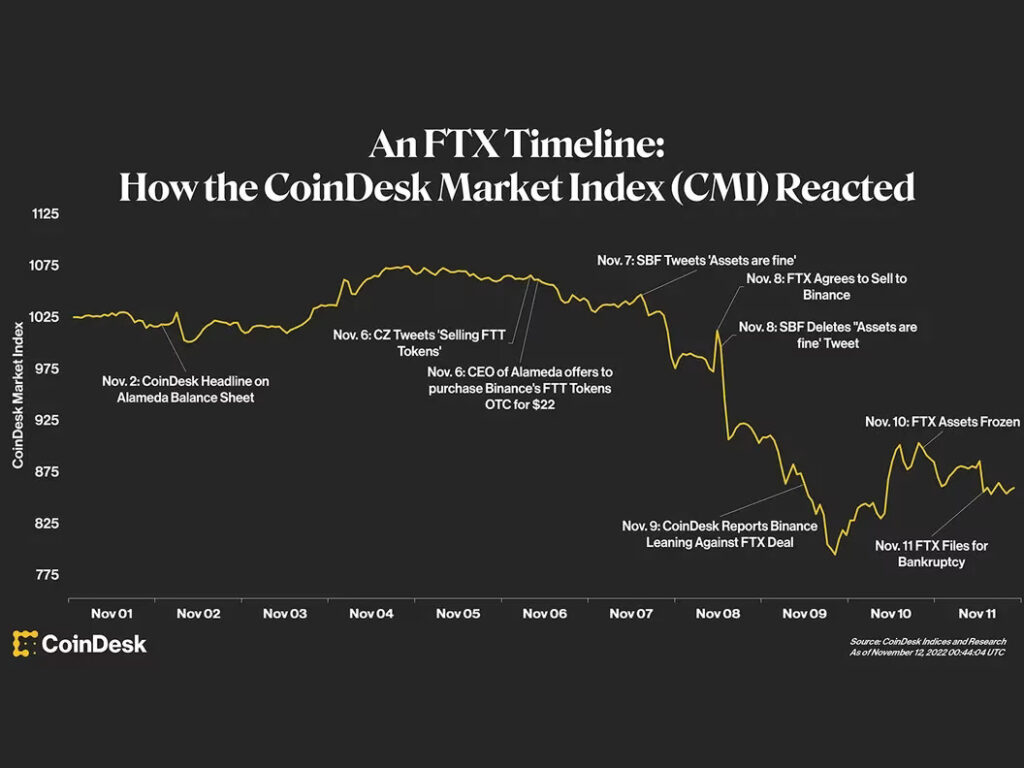

The Fall of FTX

The fall of FTX, a cryptocurrency exchange, has raised concerns about the stability and regulation of the cryptocurrency market. FTX filed for bankruptcy due to insufficient reserves to meet customer demand. The collapse has also affected academia, depriving researchers of grants and raising fears of forced repayment. Despite this setback, cryptocurrency continues to evolve globally, including in India, where the legal status of cryptocurrencies remains uncertain. Bitcoin, Ethereum, Dogecoin, and Binance Coin are some of the notable cryptocurrencies that have impacted the industry. Bitcoin and Ethereum differ in purpose and supply, but both are decentralized and rely on secure, transparent blockchains.

Downfall of Cryptocurrency

In 2022, the cryptocurrency market faced another major downturn, with many leading cryptocurrencies experiencing substantial drops in value. For example, Bitcoin, the largest and most well-known cryptocurrency, saw its value fall by over 50% from its all-time high in November 2021. Ethereum, another popular cryptocurrency, saw a similar decline, falling by approximately 40% from its peak. The total market capitalization of the cryptocurrency market also suffered a significant decline, losing over $1 trillion in value. Despite these setbacks, the industry continues to grow and evolve, with many investors and enthusiasts remaining optimistic about the potential of cryptocurrencies to revolutionize the financial landscape. As with any emerging market, it is important for investors to stay informed and understand the risks involved in investing in cryptocurrencies.

Notable Cryptocurrencies

1. Bitcoin: The first and most popular cryptocurrency, created in 2009 by an anonymous person/group using the pseudonym Satoshi Nakamoto. It operates on a decentralized network and uses a proof-of-work consensus algorithm.

2. Ethereum: a platform that operates in a decentralized manner and allows developers to build decentralized applications and execute smart contracts. Created in 2015 by Vitalik Buterin, it uses a proof-of-stake consensus algorithm and its own programming language, Solidity.

3. Dogecoin: A meme-inspired cryptocurrency created in 2013 by Billy Markus and Jackson Palmer. It features the Shiba Inu dog from the famous “Doge” meme and has gained a large following due to its community-driven and lighthearted nature

4. Binance Coin: A cryptocurrency created by the Binance exchange in 2017 means of exchange, while Ethereum was created as a platform for decentralized applications and smart contracts. This difference has resulted in the two cryptocurrencies having specific use cases and valuations.

Bitcoin vs Ethereum: Which one is Better?

Bitcoin and Ethereum are two renowned cryptocurrencies that have significantly impacted the development of the crypto industry. They differ in purpose and supply, but both are decentralized and rely on secure, transparent blockchains. Their values are driven by market forces and are prone to price changes.

Bitcoin utilizes a public blockchain, allowing anyone to join the network by running a node or mining Bitcoin. Transactions are confirmed by a network of nodes that verify the transaction and add it to the blockchain, creating a distributed ledger that records all Bitcoin transactions, ensuring security and transparency.

Ethereum, on the other hand, operates on a blockchain that enables developers to create decentralized applications and smart contracts. These applications function on the Ethereum Virtual Machine (EVM), a decentralized platform that runs code on the blockchain.

While Bitcoin was primarily designed as a store of value and medium of exchange, Ethereum was developed as a platform for decentralized applications and smart contracts. This distinction leads to different use cases and valuations for the two cryptocurrencies.

Bitcoin has a limited supply of 21 million coins, projected to be mined by 2140. In contrast, Ethereum’s supply is unlimited, with new coins generated through mining.

Despite their differences, Bitcoin and Ethereum share some common ground. Both are decentralized and function on secure, transparent blockchains. They are also subject to market dynamics, with their values determined by supply and demand.

In recent years, both cryptocurrencies have experienced notable price fluctuations. For instance, Bitcoin hit an all-time high of nearly $64,800 in April 2021, only to face a sharp decline in the following months. Likewise, Ethereum reached an all-time high of over $4,815 in November 2021 before undergoing a correction as well. Currently, the value of Bitcoin is $28,143 and Ethereum is $1,877.19.

Conclusion

Cryptocurrency and blockchain technology are intricate concepts with the potential to revolutionize how we conduct transactions and store value. As the utilization and regulation of cryptocurrencies continue to progress, it is crucial to comprehend the fundamental and advanced aspects of these technologies to make informed decisions regarding investment and usage. Staying up-to-date with the latest news and developments in the cryptocurrency arena is essential for making informed choices about buying, selling, or holding these digital assets.