What Are Regulatory Sandboxes: Fostering Fintech Innovation and Stability

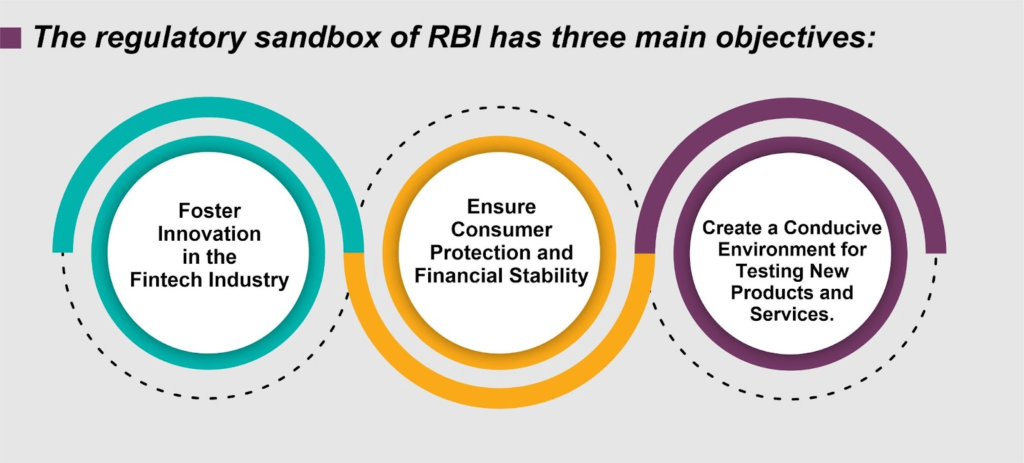

The Reserve Bank of India (RBI) launched the regulatory sandbox in 2019 to support and foster innovation in the fintech industry while ensuring consumer protection and financial stability.

A regulatory sandbox is a special program created by the government to help new and innovative businesses in the financial technology (fintech) industry test their ideas in a safe and controlled environment. It allows these businesses to experiment with new products and services without having to worry about meeting all of the usual rules and regulations. This helps these businesses to see if their ideas are successful, and it also helps the government to make sure that customers are protected and the financial system remains stable. Think of it like a playground where fintech businesses can try out new things and play without getting into trouble.

The concept of regulatory sandboxes in India originated from the Inter-Regulatory Working Group on FinTech and Digital Banking, which recommended the creation of a sandbox in 2016. Whereas, The RBI published its first framework for a regulatory sandbox in 2019.

Since then, the RBI has launched four cohorts (segments) of the regulatory sandbox. In the first cohort, ten fintech companies were selected for testing. The second and third cohorts were focused on fintech solutions for financial inclusion and digital identity verification, respectively. The fourth cohort, launched in 2021, focused on mitigating financial fraud.

The Insurance Regulatory and Development Authority of India (IRDAI) launched a regulatory sandbox in 2021 for the insurance industry. Insurers were granted the opportunity to experiment with novel products, services, and business models within a carefully regulated environment, thanks to the implementation of the sandbox.

The Ministry of Agriculture and Farmers Welfare is also exploring the possibility of a regulatory sandbox for the agricultural sector. The sandbox will aim to promote innovation in agricultural technology, improve access to finance for farmers, and boost rural entrepreneurship.

The application process for the regulatory sandbox of RBI involves three stages, which are Expression of Interest (EOI), Fit and Proper Assessment, and Selection of Participants. It has several key features, including limited regulatory requirements and exemptions, a well-defined testing period, continuous monitoring and evaluation, and a well-defined exit strategy.

The eligibility criteria to be considered for the regulatory sandbox, include being a registered company in India, having a minimum net worth of INR 50 lakh, a product or service that is innovative and has the potential to address a gap in the market, and a clear testing plan with a well-defined exit strategy.

Why should a fintech company be interested in a Regulatory Sandbox:

- It provides a safe space for fintech companies to experiment with new technologies and business models, promoting innovation in the industry. This can lead to the development of new, more efficient products and services that can benefit consumers and businesses alike.

- Its framework provides a controlled environment for testing new products and services, allowing companies to identify and mitigate potential risks before launching them in the market. This can reduce the risk of failure and increase the chances of success for fintech companies.

- It can help fintech companies to reduce the time to market their products and services. The controlled testing environment allows companies to quickly identify and resolve any issues that may arise, allowing them to launch their products and services faster.

Despite their many benefits, regulatory sandboxes also face several challenges, including:

- The risk of regulatory arbitrage, where companies take advantage of the relaxed regulatory requirements in the sandbox to engage in activities that would not be permitted outside of it. This can pose a risk to consumer protection and financial stability.

- Regulatory sandboxes require effective monitoring and evaluation to ensure that they achieve their objectives while mitigating the associated risks. This can be challenging, as it requires a balance between promoting innovation and ensuring consumer protection and financial stability.

Regulatory sandboxes provide an opportunity for banks to collaborate with fintech firms and leverage their innovative technologies and business models to improve their products and services. It can also encourage banks to innovate and develop new products and services that can meet the changing needs of consumers and businesses.

Regulatory sandboxes have emerged as an important tool for promoting innovation in the fintech industry while ensuring consumer protection and financial stability. The regulatory sandbox of RBI has been successful in promoting fintech innovation in India, and its impact on the future of fintech and the Indian banking system will be significant. However, it is important to continue monitoring and evaluating regulatory sandboxes to ensure that they achieve their objectives while mitigating the associated risks. The future of the fintech industry in India looks bright, and regulatory sandboxes will play a key role in shaping it.